Amex OptBlue and level 3 processing are two of the most important things to happen to the payment processing world since the invention of the credit card itself. Both of them are great innovations that helped businesses develop and thrive and have redefined what a company’s goal can be.

What Is Amex Optblue?

American Express is one of the leading financial organizations in the United States and a name very easily recognized worldwide. For decades they have been offering top-notch financial services to both individuals and companies alike. This is why so many people want to link their names to the Amex reputation. When you are working with American Express you know you are in great company.

In 2014 American Express took things a step further by introducing Amex OptBlue. This revolutionary move gave any account provider the possibility to process payments made with an American Express credit card. Until then, any business wanting to accept American Express had to have a separate American Express account. By introducing this option American Express joined with fellow card issuers Visa and MasterCard and offered merchants the possibility of accepting payments regardless of the account provider

Once OptBlue was launched, American Express became more appealing to merchants. Along with that a lot of other things improved too:

– Payments were now more streamline;

– Reconciliations became easier to do by using a single account provider;

– There were no more operating schedule conflicts so the payments could go through faster;

– All the transactions of a merchant were now on a single bill, instead of having multiple bills from multiple accounts;

– Account providers could now improve their customer service when it came to American Express related questions from their clients;

– Rates could be more easily negotiated.

What Are The Advantages Of Using Amex Optblue?

America Express came up with Amex OptBlue in a bid to try and convince business owners to work with them. Although a well-established American institution already, American Express had some of the highest fees and rates on the market. That made a lot of business owners to refuse to work with them. With their new financial product up and running American Express started to gain some traction with the owners and has been offering them the possibility of negotiating rates so as to become more competitive. So far it worked, and people started seeing other advantages of working with American Express too.

The biggest advantage every business owner has noticed is the reduction in transaction fees. This may very well have been the winning strike for American Express’s new service. Discount rates could now be negotiated and this made American Express a favorite among merchants.

As opposed to the old AMEX ESA solution, the new and improved American Express service offers a far more transparent way of looking at transactions. This way, merchants know exactly how much each transaction costs them and this has been a real leap forward in terms of making friends out of the business owners.

Daily reconciliation has been made easier once the new American Express services reduced the time needed from a whapping 5 days to a mere day. That was a move everybody got behind of.

What Is Level 3 Processing

Level 3 processing refers to the amount of data a company offers its credit card processors in order to reduce the costs of each transaction. This level is usually reserved for big companies that have large volumes of transactions each day and want to save some money. The way this works is the higher the level of processing, the more information a business has to give out. Of course, special security measures are taken in order to ensure that data doesn’t leak.

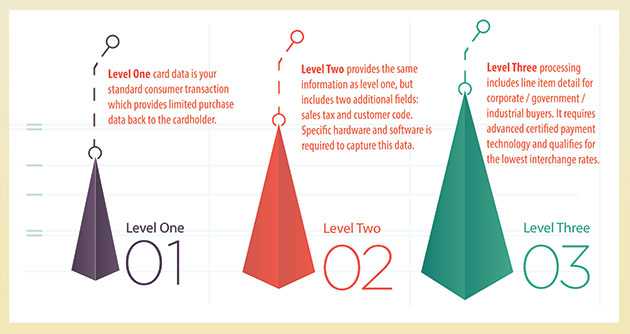

Levels of data processing

To better understand what each level of data processing means you should know this :

Level 1: This is the base level for any business. The information required at this level is the bare minimum in order to make sure that the transactions it makes are OK. The information needed for this level are:

- Merchant name

- Amount of transactions

- Date of transaction.

Level 2: Each level you go up requires additional information on top of what you have given at the previous level. That’s why this level requires:

- all level 1 data requirements

- Customer code

- Total tax amount.

Level 3: This is the highest level of processing, usually reserved only for big companies. Because the amount of information they are required to give, this is where the real benefits of reduced transaction fees really kick in. Level 3 processing requires:

- all data for Levels 1 and 2

- Postal code for shipping location

- Recipient postal code

- Invoice number

- Order number

- Amount

- Line item details of the purchase.

But you don’t just get to be qualified for Level 3 only because you want to be. Each business has to submit a series of documents that certify that their transactions are real. Also, depending on your credit card issuer, you will be required to have a minimum volume of transactions per day. For Visa and MasterCard for instance, the minimum value of transactions needed to qualify for level 3 is between 20,000 and 1 million.

What are the benefits of Level 3 Processing?

There are a lot of benefits associated with level 3 processing status. Maybe the biggest of them all is the reduced costs in interchange transactions. This is why all bug companies mainly want to obtain this status. But there are a lot of other advantages of gaining a level 3 status. One of the more important ones is the possibility of tracking any purchase made, regardless of size. Another big advantage would be the fact that you would get notified the minute any suspicious activity is taking place on your account or if anyone is trying to use your credit card without the proper authorization.

When a business reaches level 3 status transactions are processed quicker, meaning that you get your money from your clients faster. This is very important especially for businesses that require a steady cash flow in order to continue to operate at full capacity.